Budgeting & Spend Control: What Every Kenyan Business Should Know

In a fast-moving business environment, every shilling counts. Many growing businesses in Kenya struggle to keep up with their spending. Approvals happen on WhatsApp, receipts get lost, and cash runs out faster than expected.

Pcash Team

Financial Technology Experts

Why Kenyan Businesses Lose Track of Their Spending

Across sectors, from construction and manufacturing to professional services, the same story plays out:

Budgets exist on paper but aren't followed in practice.

Approvals happen informally, sometimes on calls or chat messages.

Teams spend via M-Pesa and forget to reconcile transactions later.

No single dashboard shows what's been spent, what's pending, and what's due.

Different branches or departments operate in silos, with little visibility at HQ.

That lack of real-time insight is what causes most financial fires.

The Hidden Cost of Poor Spend Management

When spending isn't controlled, the ripple effects are serious

Cash Crunches

Payments get delayed, staff salaries stall, and vendors lose confidence

Poor Forecasting

Decisions are made without knowing true financial standing

Internal Tension

Operations teams feel restricted, finance teams feel blindsided

Audit Nightmares

Missing receipts and undocumented approvals waste time

Missed Growth Opportunities

Capital that could fund expansion ends up wasted on inefficiencies

You can't manage what you can't measure.

Financial visibility isn't just about compliance. It's about control, confidence, and growth.

Managing Project Budgets: The Overlooked Challenge

Most businesses track spending by department, but in reality, spending often happens by project or initiative. A team might have multiple projects running simultaneously, each with its own budget and timeline. Yet all expenses get thrown into a single departmental category.

What Happens Without Project Budgets?

You lose track of project costs

Did that initiative really deliver ROI? You can't say, because you don't know the total cost across all related expenses.

Projects go over budget silently

No one realizes until month-end that Project A overspent while Project B was underfunded.

You can't make data-driven decisions

Which initiatives deliver the best value? Which project types drain resources? You have no clear answers.

Real-World Example

A growing business in Kenya manages multiple projects simultaneously. Each project (client deliverables, internal initiatives, expansion efforts) has its own scope and budget.

The Problem:

Team members expense travel, materials, and contractor fees, all billed to general departmental budgets. By the time management realizes one project burned through Ksh 500,000 over budget, the deliverables are complete and there's no way to recover those costs.

When you manage spending by project, not just by department, you unlock true financial accountability.

You know which projects deliver value and which ones drain your budget.

How Pcash Simplifies Project Budgeting

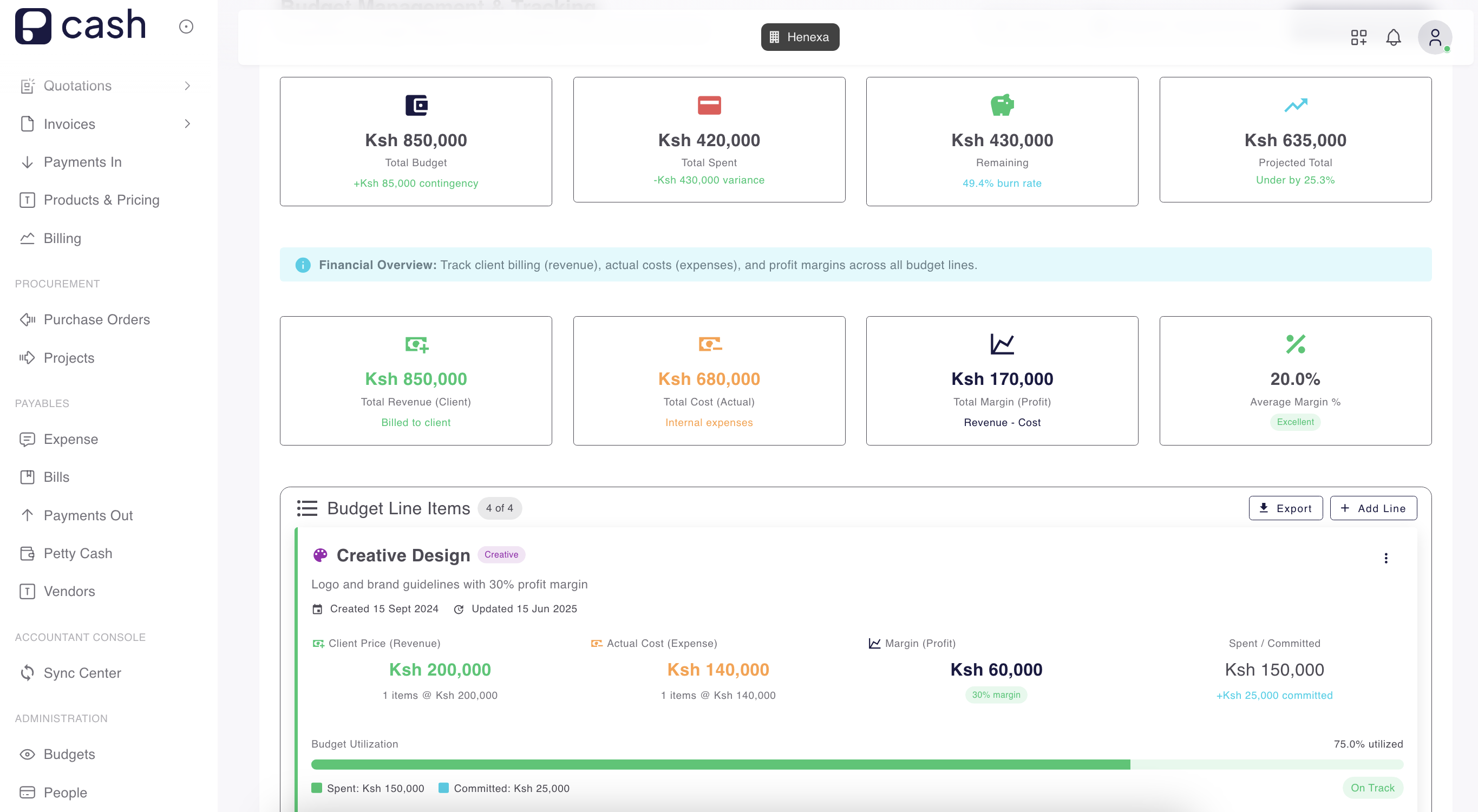

Unlike traditional spend management tools, Pcash supports multi-level budgeting. You can set budgets at the department level and at the project level, all in one place.

Assign Budgets Per Project

Create budgets for individual campaigns, client projects, or internal initiatives. No more throwing everything into a single bucket.

Tag Every Expense

When a team member submits an expense, they select which project it belongs to. Approvers see the project's budget status instantly.

Track Real-Time Progress

View a live dashboard showing how much each project has spent vs. its allocated budget. No guessing, no spreadsheets.

Close Projects with Confidence

When the project ends, you have a complete financial record. You know exactly what you spent and whether the project was profitable.

A Simple 5-Step Budgeting Framework

Building a culture of financial discipline doesn't happen overnight. Here's a practical roadmap to get there.

Define Your Budgets

Start with high-level department budgets. Then break them down by project or campaign if needed. Be realistic and base them on past spending and future goals.

Centralize Expenses

Move away from WhatsApp receipts and personal M-Pesa. Use a single platform where all expenses are logged, categorized, and linked to budgets.

Automate Approvals

Set up approval rules. For example, expenses under Ksh 5,000 auto-approve, above that go to a manager. This speeds up small purchases while protecting big ones.

Monitor Real-Time

Don't wait for month-end reports. Check your dashboard weekly (or daily). Spot issues early: a project running hot, a department overspending.

Review & Adjust

At month-end, review what worked and what didn't. Adjust budgets for the next cycle. Financial discipline is a learning process.

This Framework Works for businesses of all sizes

Whether you're a 10-person startup or a 100-person enterprise, the principles are the same: define budgets, centralize expenses, automate approvals, monitor in real-time, and continuously improve.

Pcash is built to support this entire framework in one platform.

The Future of Financial Discipline for Kenyan SMEs

As Kenya's digital economy grows, businesses can't afford to run on outdated financial tools

Project-Level Budgeting

Track every campaign, client project, and initiative separately. No more blind departmental spending

Real-Time Budget Visibility

See exactly where you stand today, not where you were last month when it's too late

Automated Approvals

Set smart rules that approve small purchases instantly while protecting big spending decisions

M-Pesa & Bank Integration

Works seamlessly with Kenya's payment ecosystem: M-Pesa, bank transfers, corporate cards

| Feature | WhatsApp & Spreadsheets | With Pcash |

|---|---|---|

| Budget Visibility | Month-end reports | Real-time dashboard |

| Project Tracking | Not tracked | Per-project budgets |

| Approval Speed | Days or weeks | Minutes or instant |

| Receipt Management | Lost WhatsApp photos | Centralized & searchable |

| Overrun Prevention | Find out too late | Proactive alerts |

Ready to Bring Financial Discipline to Your Business?

Join the growing number of Kenyan businesses using Pcash to track project budgets, automate approvals, and prevent budget overruns before they happen.